Financial Aid Application Time

ACM College Consulting

SEPTEMBER 26, 2020

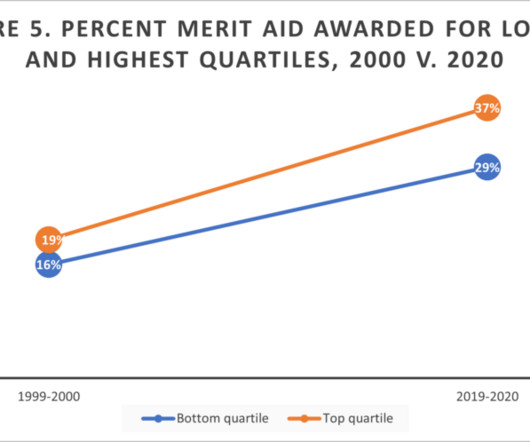

As college application season is fully underway, it is important to learn about the primary financial aid applications and types of aid your student could receive. So if you are applying for 2021-22, you will use 2019 and 2020 information. Other than that, do not delay completing your financial aid applications.

Let's personalize your content